2024 ANNUAL REPORT

Learn more about the path we took in 2024 and what’s on the Horizon for 2025! The statements, figures and information provided here are current as of January 1, 2025 and reflect the fiscal year of 2024.

Table of Contents

Letter From the CEO

Change seems to be the one constant in our lives whether in the financial landscape, economy or the way we do business. As we reflect on the past year, it’s clear that Horizon Credit Union continues to evolve and thrive. Despite challenges in the broader operating environment, we have stayed true to our mission and guiding principle: “Your Path, Our Purpose.” This philosophy is at the heart of everything we do, from the services we offer to the way we support you, our members, every day.

With over $2B in assets and a capital level considerably over regulatory requirements, we are well-positioned to serve our 110,000+ members. Over the past year, we have made significant investments in our delivery of services. This includes in-branch, contact center and digital channels ensuring that your experience with Horizon remains seamless and convenient. The trend towards more frequent digital interactions and ease of money movement continues to drive many of our strategies. However you choose to interact with us, we will continue to work hard to provide solutions that fit your evolving lifestyle and financial goals.

At Horizon, we remain deeply committed to offering personalized service and helping you navigate an increasingly complex financial world. Our team continues to bring fresh perspectives and a dedication to ensuring that you have access to the tools and resources needed for financial success. The relationships we’ve built with you are what truly define us, and we are grateful for your trust and continued partnership.

We are also proud of the impact we continue to make in our communities. As a credit union, giving back is part of our DNA, and this year our team dedicated their efforts to supporting the markets we serve in the areas of health, hunger and education. In addition, we delivered over 7,000 hours of financial education, empowering individuals and families to make informed financial decisions.

On behalf of the entire Horizon Credit Union team, including the board of directors, supervisory committee and staff, thank you for your continued trust in us. We look forward to partnering with you for many years to come as we work together to achieve your financial goals.

President/CEO

Horizon Credit Union

Report from the Board of Directors Chair

2024 was another challenging year for financial institutions, but the team at Horizon Credit Union took it all in stride. They worked tirelessly to maintain the credit union’s strong financial position and serve members with the same excellent service you have come to expect. Kudos to our management team and employees!

The driving force behind our success and ability to overcome challenges is our culture. It is intentional – a desire for teamwork and collaboration demonstrated daily by every Horizon employee. Many of our dedicated employees have served Horizon for 10, 20, even 30 years, faithfully fulfilling our commitment to you: to provide you with a positive experience each time you visit a branch, give us a call or log in to online banking.

Another commitment we share is giving back to the communities where we serve. In 2024 our employees gifted over 10,000 volunteer hours to 262 organizations and charities. Few organizations are so dedicated to giving back to their communities in this way. Horizon Credit Union is, and this commitment makes Horizon truly special to employees and recipients.

In conclusion, I want to express my sincere appreciation to our board of directors and supervisory committee who keep Horizon strong and serve our membership to the best of their abilities. Their dedication to serving members and giving back gives me utmost confidence that we will continue through 2025 stronger than ever.

Chairman of the Board

Horizon Credit Union

Board of Directors

Steve Sharon ……………………………………………………………… Chair

Mike Butler …………………………………………………….. 1st Vice Chair

Mark Lodine ………………………………………………….. 2nd Vice Chair

Darin Burrell …………………………………………….Secretary/Treasurer

Pat Marler ……………………………………………………………… Director

Tom Diluzio ……………………………………………………………. Director

Renn Salo………………………………………………………………. Director

Bernie Korth ……………………………………………… Director Emeritus

Board of Directors

Steve Sharon ……………………………………………………………… Chair

Mike Butler …………………………………………………….. 1st Vice Chair

Mark Lodine ………………………………………………….. 2nd Vice Chair

Darin Burrell …………………………………………….Secretary/Treasurer

Pat Marler ……………………………………………………………… Director

Tom Diluzio ……………………………………………………………. Director

Renn Salo………………………………………………………………. Director

Bernie Korth ……………………………………………… Director Emeritus

Board of Directors

Steve Sharon

Chair

Mike Butler

1st Vice Chair

Mark Lodine

2nd Vice Chair

Darin Burrell

Secretary/Treasurer

Renn Salo

Director

Pat Marler

Director

Tom Diluzio

Director

Bernie Korth

Director Emeritus

Report from the Supervisory Committee Chair

The supervisory committee is a volunteer committee responsible for reviewing the financial operations of the credit union in accordance with the regulatory procedures established by the Washington Department of Financial Institutions (DFI), the National Credit Union Administration (NCUA) and the credit union’s policies to safeguard member assets and assure you are provided the quality service you deserve.

The supervisory committee includes the following volunteers: Interim Chairperson / First Vice Gail Gudgel and committee members Bob Lochmiller, Brian Eldred, Kathleen Cooper and Jim Jopson. Vanessa Gartz, CIA, director of internal audit, manages the internal audit department and reports independently to this committee.

Our annual financial statement audit was conducted by the certified public accounting firm of Opsahl Dawson. The annual audit covers a review of internal controls, audit evidence and financial accounting support. Audited financial statements were issued and a report submitted to the supervisory committee.

This year’s report concluded that for the period ending December 31, 2024, the financial position, operations, cash flows and subsequent financial statements are in all material respects presented fairly in conformity with GAAP.

Throughout the year our internal audit department performs audit procedures on selected areas of the credit union. Our regulators, the Washington State DFI and NCUA, also perform annual safety and soundness examinations. The supervisory committee reviews all audits and examinations conducted throughout the year to make certain the board of directors and management respond to recommendations made.

The supervisory committee is committed to open lines of communication to our member-owners to ensure you receive the highest quality service. If any member has a concern or issue, please send a letter to the following address: Horizon Credit Union Supervisory Committee, P.O. Box 6, Spokane Valley, WA 99037-9901. The Supervisory Committee will review your letter and respond.

Supervisory Committee Interim Chair / First Vice

Horizon Credit Union

Supervisory Committee

Bob Lochmiller …………………………………………………… Chair

Gail Gudgel ………………………………. Interim Chair / First Vice

Brian Eldred …………………………………………………… Member

Kathleen Cooper …………………………………………….. Member

Jim Jopson …………………………………………………… Member

Supervisory Committee

Bob Lochmiller ………………………………………………….. Chair

Gail Gudgel ……………………………….Interim Chair / First Vice

Brian Eldred ………………………………………………….. Member

Kathleen Cooper ……………………………………………. Member

Jim Jopson …………………………………………………… Member

Supervisory Committee

Bob Lochmiller

Chair

Gail Gudgel

Interim Chair / First Vice

Brian Eldred

Member

Kathleen Cooper

Member

Jim Jopson

Member

HZCU GO-GIVERS

We supported 262 organizations

Need a helping hand? How about 798 of them!

350+ employees volunteered for GGG

That’s 1,400 hours for Go Give Grow day!

We hosted 7,227

hours of financial education

4,782 individuals were helped!

HZCU EMPLOYEES DONATED

FOR COMMUNITY SPIRIT DAYS!

Together with corporate matching, $18,633 was given directly to 33 members experiencing extreme hardship.

2024 Income Statement

(In thousands of dollars)

| INTEREST INCOME | 2024 | 2023 |

|---|---|---|

| Loan interest income | 92,985 | 82,470 |

| Investment interest income | 9,271 | 13,417 |

| Total Interest Income | 102,256 | 95,887 |

| INTEREST EXPENSE | ||

|---|---|---|

| Members’ shares | 35,422 | 28,775 |

| Interest on borrowed funds | 73 | 154 |

| TOTAL INTEREST EXPENSE | 35,495 | 28,929 |

| NET INTEREST INCOME | 66,761 | 66,958 |

|---|---|---|

| Provision for loan losses | 9,533 | 5,278 |

| Non-interest income | 14,819 | 14,707 |

| Non-interest expense | 67,954 | 70,743 |

| Net Income | 4,093 | 5,644 |

2024 Balance Sheet

(In thousands of dollars)

| BALANCE SHEET | 2024 | 2023 |

|---|---|---|

| Loans to members | 1,699,811 | 1,706,395 |

| Allowance for loan loss | (11,082) | (9,300) |

| NET LOANS TO MEMBERS | 1,688,729 | 1,697,095 |

| Cash & cash equivalents | 144,761 | 183,217 |

| Investments | 51,455 | 49,157 |

| Other assets | 125,026 | 125,808 |

| TOTAL ASSETS | 2,009,971 | 2,055,277 |

| Member shares | 1,698,683 | 1,788,938 |

| Borrowed funds | 40,000 | – |

| Other liabilities | 26,733 | 25,884 |

| TOTAL LIBILITIES | 1,765,416 | 1,814,822 |

| TOTAL CAPITAL | 244,555 | 240,455 |

| TOTAL LIABILITIES & CAPITAL | 2,009,971 | 2,055,277 |

About Horizon

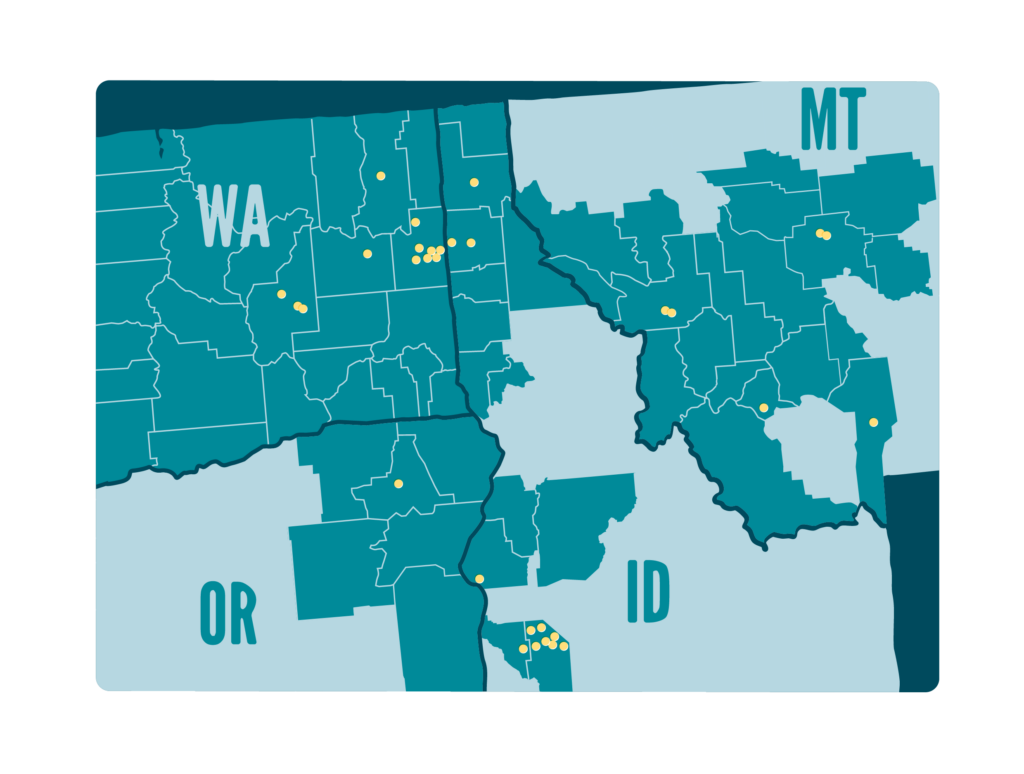

Our journey began as a partnership of metal workers at Kaiser Aluminum in Spokane, Washington in 1947. As we moved forward on our path and our members grew and gained financial security, people saw the benefit of coming together.

From highway workers to educators to health care professionals and forestry workers we’ve come together as Horizon Credit Union. We’re here to provide you with the expanded access and services of a regional credit union and friendly, authentic advice tailored to you – by people like you – no matter which part of the northwest you call home.